Industry News

EU member states agreed on Thursday (November 13) to abolish the customs duty exemption for low-value parcels. This measure will affect retail giants like Temu and Shein, aiming to curb the influx of inexpensive Chinese goods into the EU market.

Global De Minimis Exemption Suspended by the US and EU in 2025 has fundamentally altered the operational environment for cross-border e-commerce. This change is driving the industry's transition from extensive growth to refined operations.

Substantial Cost Increases Render Low-Price Models Unviable

United States: The removal of the duty-free treatment for parcels under $800, replaced by high tariffs, coupled with a shift in customs clearance from T86 to T11, adds at least $2.60 in processing fees per shipment. Overall logistics costs have risen by 20%-30%, leaving minimal profit margins for low-margin goods.

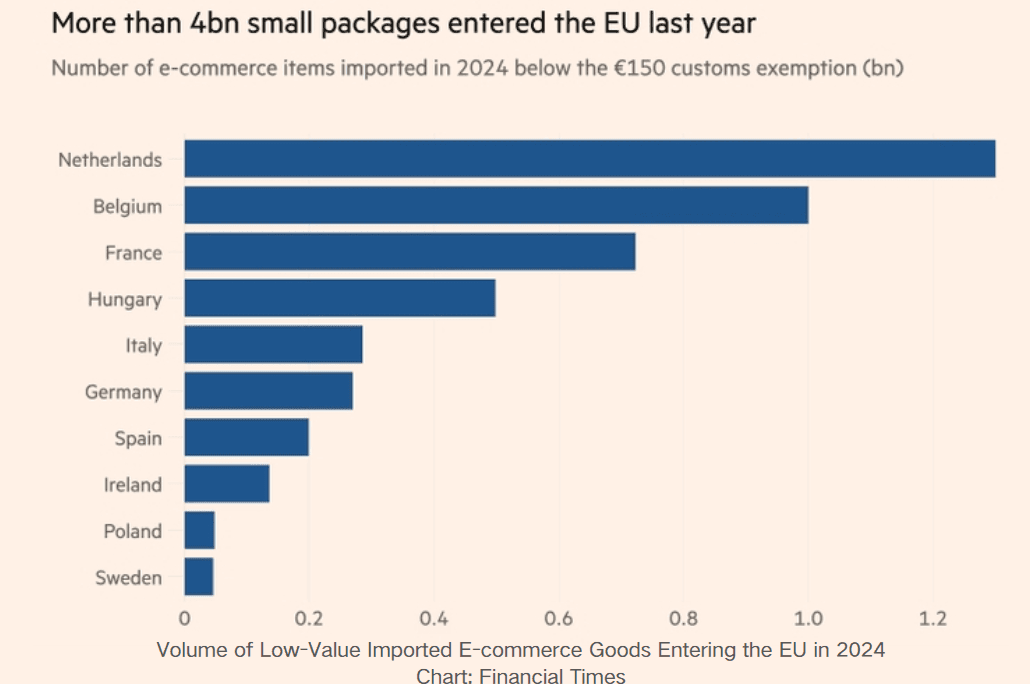

European Union: The imposition of a flat €2 fee on direct mail parcels deals a severe blow to low-priced goods under €30. Data shows that 4.6 billion such small parcels entered the EU last year, 91% of which originated from China, expected to continue growing. The traditional strategy of small profits but quick turnover is becoming unsustainable.

Operational Complexity Accelerates Industry Reshuffle

Heightened customs requirements lead to increased inspection rates and extended processing times. Uncertainty in policy implementation further adds operational risks, frequently disrupting logistics plans.

SMEs with limited capital are under significant pressure; an estimated 30% of sellers may exit the EU market. Large platforms, leveraging their resource advantages, are expanding their market share, leading to increased industry concentration.

Clear Transformation Direction Establishes New Models

Overseas warehouses are becoming an essential choice. By stocking goods in bulk via sea freight, per-unit costs are reduced while delivery times are shortened. Chinese tax refund-upon-departure policies also encourage this transition.

Platforms are adjusting their operational strategies: initially by raising prices to pass costs onto consumers; simultaneously accelerating localization by recruiting local sellers to reduce reliance on small parcel exemptions; and introducing hybrid models, between fully-hosted and semi-hosted, aiming to alleviate tariff pressure.

Policy changes have also triggered structural adjustments in supporting cross-border service industries. Small parcel logistics providers are facing severe impacts due to reduced business volume and increased customs clearance difficulties, leading not only to higher service costs but also customer attrition.

New Opportunities: Overseas Warehousing Becomes a Cross-Border Necessity

With the end of de minimis exemption globally, logistics models for cross-border enterprises targeting European and American markets are undergoing profound restructuring. The "bulk sea freight + local delivery" overseas warehousing is rapidly emerging, propelling the related service market into a period of rapid development. In this context, selecting a reliable and efficient overseas warehouse partner has become a key determinant of business success.

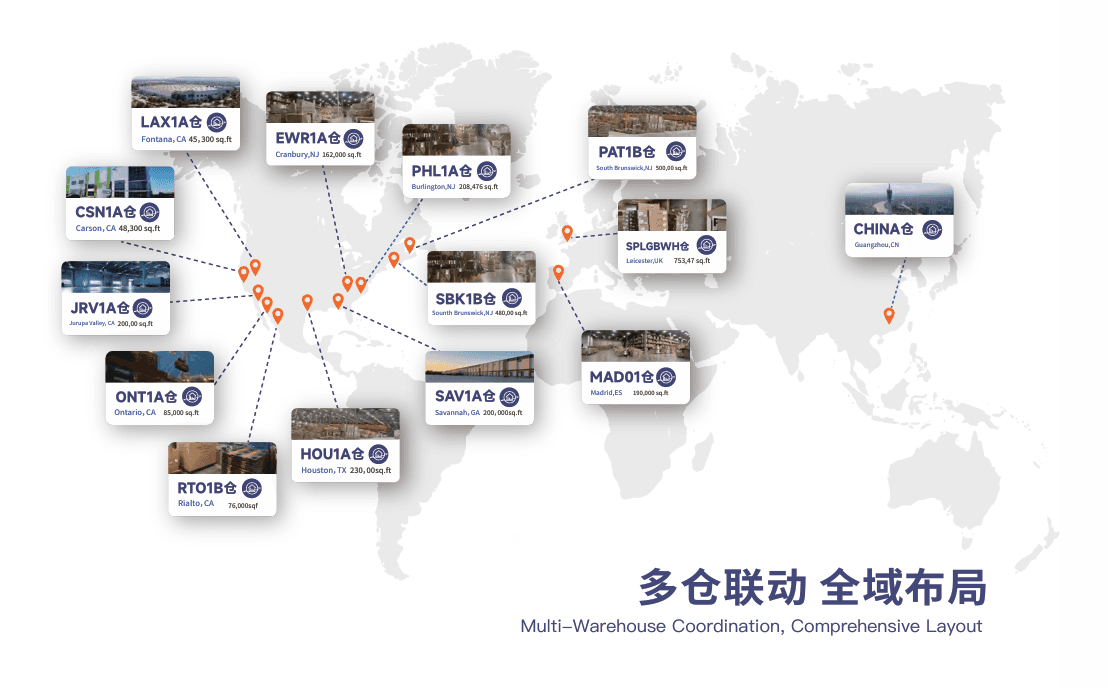

AWESUNG, as a leading provider of e-commerce warehousing and logistics in North America and Europe, offers robust localized support for cross-border e-commerce with its solid infrastructure and technological strength:

Extensive Warehouse Coverage Network: Strategic warehouses located near the 4 major ports in the US, with a total storage area exceeding 2.5 million square feet, forming efficient logistics hubs radiating across the US.

End-to-End Intelligent Management Systems: Through self-developed management systems like TMS, OMS, BMS, DMS, and WMS, achieving automated operations across the entire chain from warehousing and distribution to data management.

Multi-Platform System Integration: Systems support rapid integration with major mainstream e-commerce platforms, enabling automatic order synchronization and significantly improving fulfillment efficiency and shipping experience.

The end of global de minimis exemption era marks cross-border e-commerce's entry into a new stage of lean operations from extensive growth. Future competition will no longer be confined to price but will shift towards a comprehensive contest involving supply chain efficiency, localized services, and brand value. Accelerating the transition to overseas warehousing, driving product upgrades towards premium quality, and actively diversifying into multiple markets will be inevitable choices for sellers to achieve steady and sustained growth in the new trade environment.